The CARES Act: The Next Wave of Government Enforcement Activity. Are You Ready?

June 24, 2020BACKGROUND

The Coronavirus Aid, Relief, and Economic Security Act (CARES Act) has provided massive financial assistance and support to businesses and individuals through cash payments and loans. An unprecedented 2.2 trillion dollars was injected into the economy to assist those impacted by COVID-19. The significant amount of taxpayer money appropriated for the pandemic response creates an environment in which fraud and other financial crimes can potentially flourish.

Similar to the aftermath of the 2008 financial crisis, the passage of the multi-trillion dollar CARES Act will trigger a wave of government audits and investigations. These investigations will target businesses and individuals who may have inappropriately used these stimulus funds – intentionally or unintentionally. Any business that has received CARES Act funding should be prepared for government scrutiny. No one wants to be the government’s next “example,” and we seek to put clients in the best possible position to avoid this.

The CARES Act includes more than just the SBA Paycheck Protection Program (PPP); it also includes loans to severely distressed sectors, including aviation, retail, hospitality, and small and midsize businesses, among others. Such loans may be seen as a bailout by the general public (though the specific amount will not be disclosed, the Trump Administration plans to disclose the names of those taking loans over $150,000), and that is one of the reasons why any company in this climate should be extremely careful.

The CARES Act created an office of the Special Inspector General for Pandemic Recovery (SIGPR). The CARES Act grants SIGPR the broad authority to “conduct, supervise and coordinate audits and investigations of the making, purchase, management and sale of loans, loan guarantees and other investments made by the Secretary of the Treasury” under Title IV of the Act. SIGPR will carry authority similar to any other inspector general, including the power to issue subpoenas and make referrals for prosecution to the Department of Justice. On June 2, 2020, the Senate confirmed the first special inspector general for pandemic relief.

It doesn’t stop there. The CARES Act mandated congressional oversight via the COVID-19 Congressional Oversight Commission (COC). This oversight body will report to Congress every 30 days on how the Department of the Treasury and the Federal Reserve Board manage the funds until September 30, 2025. These reports will assess:

- The economic impact the disbursements have on the populace, financial markets, and financial institutions.

- The transparency of how the money is used.

- The long-term costs and benefits to taxpayers taking on loans made by the legislation.

And, the House of Representatives (the House) has created a special committee on the crisis. This committee has a very broad mandate to examine all aspects of the COVID response. And, there’s more. Three other House committees have started active investigations into CARES Act Spending, including the House Oversight and Reform Committee and the Oversight and Investigations subcommittee of the House Energy and Commerce Committee.

This work will require tailored approaches and solutions for specific industries and clients. Our curated network of sophisticated experts, which we have fostered over decades, enables us to strategically assemble and lead integrated, multi-disciplinary teams as needed. This includes accounting firms, public relations firms, political and academic advisors, industry experts and other advisors. If we ourselves lack subject matter expertise, we are quick to acknowledge it and tap our network to assist us in order to put together the absolute best team available to achieve our clients’ goals.

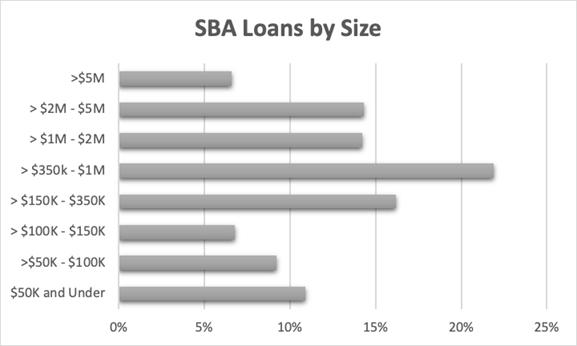

HOW BIG WERE THE LOANS?

Source: www.sba.gov/sites/default/files/2020-06/PPP_Report_20200612-508.pdf

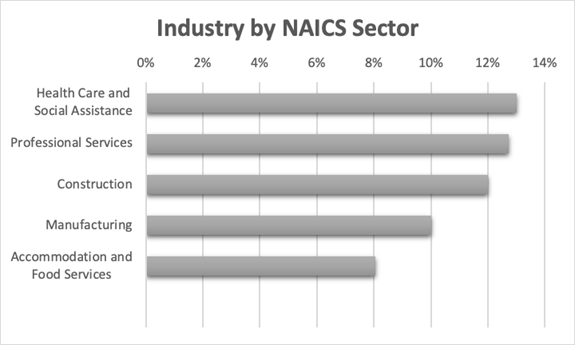

WHICH SECTORS RECEIVED THE MOST?

Source: www.sba.gov/sites/default/files/2020-06/PPP_Report_20200612-508.pdf

WHAT GOVERNMENT ENFORCEMENT ACTIONS ARE WE EXPECTING?

- There have only been a handful of enforcement actions thus far, and therefore no set pattern on who the government will pursue. The public actions so far have involved blatant fraudulent behavior that was very unlikely the result of a misunderstanding.

- Recent reports that the Department of Justice (DOJ) sent PPP-related subpoenas to major banks likely reflect DOJ’s efforts to build cases against applicants by showing that a bank account was only recently created to receive PPP funds.

- Notwithstanding that the enforcement actions we have seen involve illegal activity, even sophisticated companies that apply for and receive PPP loans and loans under other provisions of the CARES Act could face allegations that they were not eligible for the loans or that they failed to use funds for qualified purposes.

- Congressional hearings have started with more on the way. Congress is looking for high-profile examples of bad faith spending efforts, especially around PPP money.

WHY BOHRER?

- Multi-disciplinary Team – combined legal, compliance, investigative, operational, financial and forensic accounting capabilities.

- Commercial Savvy – having been fiduciaries, executives and in-house counsel ourselves, we bring first-hand knowledge of what is needed to achieve commercial objectives while simultaneously evaluating and mitigating risk.

- 360° Perspective – our team has dealt with high-profile government investigations and enforcement actions from all perspectives, having held roles in-house in the business world, and in the government as a federal prosecutor.

- Our Network – diverse network of government, law enforcement and prosecutors who can help anticipate direction of future enforcement activity as the situation develops. We also have strategic partnerships with several accounting firms and communications firms, including a firm that is involved in the drafting process for the CARES Act guidance.

SERVICES

Compliance and Government Examination Preparedness Assessment

- Review current compliance procedures to ensure the information companies are submitting to the government is accurate, and that the records supporting the submissions are properly maintained. Where current procedures are not adequate, provide recommendations for areas of improvement.

- Review corporate documents to ensure adequate disclosure of any affiliated entities; if necessary and appropriate, discuss amending corporate documents.

- Audit costs and expenses where funds were used:

- Ensure organizations are using funds properly and not potentially subject to allegations of fraud;

- Ensure organizations are using funds in such a way as to reduce repayment obligations and maximize loan forgiveness;

- Ensure organizations are complying with restrictions for use of any funds received under the CARES Act.

- Loan forgiveness – interpret the rules and provide road map for best practices.

- Review D&O, E&O and other relevant insurance policies to ensure maximum protection for the business and leadership.

Employee Terminations and Compensation

- Establish policies and procedures for employee compensation, layoff, furlough, termination, or Reduction in Force (RIF) decisions.

- Review employment decisions and actions to assess potential impact on stimulus funds received.

- Develop and review appropriate termination and release agreements to ensure maximum protection for the companies.

- Note: this is particularly important given the whistleblower risks associated with potentially aggrieved former employees.

Counsel Regarding Government Enforcement Trends and Guidance

- Provide updates and make recommendations to clients as the enforcement landscape develops.

- Review and continuously monitor government guidance. Our network receives information regarding new guidance before it is publicly announced, which allows us to provide real-time advice to prevent problems before they occur.

Response to Government Examinations, Inquiries, Investigations

- Review inquiries from federal, state or local authorities.

- Review and manage the public risk associated with investigations.

- Correspond and negotiate with the government on behalf of clients.

- If necessary, defend criminal actions brought by the government.

- Defend civil lawsuits that may be brought by plaintiffs’ attorneys (unclear if there will be private causes of action under the CARES Act)